For Immediate Release – July 28, 2020

Northern Sunrise County was notified on July 24, 2020 of changes proposed by the Provincial Government to reduce the property tax of oil and gas companies through changes to the assessment model for regulated properties in this sector.

Council and Administration are extremely concerned about the serious impacts of this decision because it will mean an increase in property tax, reduction of services, or a combination of both to make up for this lost revenue.

While the stated intention of this decision is to increase the competitiveness of oil and gas companies in this hard time, these changes will disproportionately benefit large oil and gas companies and harm smaller local firms.

In addition, there are no regulations to ensure that this money from the reduction in taxes will be spent or reinvested in Alberta to improve the struggling oil and gas sector here. There are few benefits to outweigh the added costs that our residents will be faced with.

There are four scenarios being presented by the technical committee (made up of Industry representatives and government advisors). Based on the information provided to us from the Province, the impacts to Northern Sunrise County from the 4 scenarios indicate a loss of approximately 17% of tax revenue, which equates to between $2.7 million and $6.3 million in overall lost revenue in the first year, and increasing in subsequent years.

To compensate for the loss of industry assessment and corresponding tax revenue, Northern Sunrise County will have to adjust operations in one of the following ways (or a combination of same):

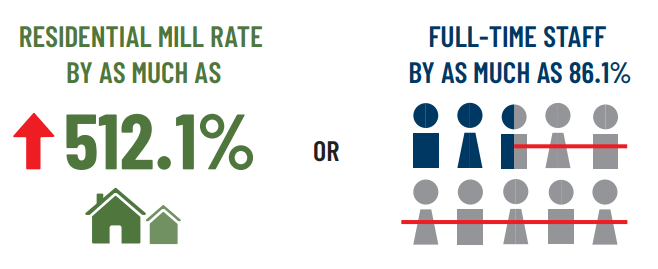

- Increase the residential mill rate between 223.4% and 512.1% AND/OR

- Increase the non-residential mill rate (businesses in Northern Sunrise County) between 11.6% – 31.3% AND/OR

- Cut the County workforce by 37.7% – 86.4% (16 to 38 full time positions) and lose the corresponding services.

If this proposed change is passed YOU WILL BE IMPACTED – financially through property taxes and in a loss of service from Northern Sunrise County. Many services provided by the County would have to be cut, County support to our neighboring municipalities (Town of Peace River and Village of Nampa) and organizations will have to be decreased or eliminated, and there would certainly be an increase in property taxes for residents and business within the County. With the additional changes to the Police Funding Model, on top of unpaid taxes from oil & gas, County residential taxpayers will see significant property tax increases in the coming years.

The Province is proposing these changes to give reductions in property taxes, and education taxes to the oil and gas industry. This loss in municipal revenue has to come from other rate payers – YOU! – either through increased taxes AND/OR decreased services.

What can you do?

Please let your MLA know your thoughts on this issue:

- MLA Dan Williams – Phone: 780.928.5100 or email: Peace.River@assembly.ab.ca

- MLA Pat Rehn – Phone: 825.219.1000 or email: Lesser.SlaveLake@assembly.ab.ca

Your local Councillors will be meeting with MLAs and working with the Rural Municipalities of Alberta (RMA) to advocate on your behalf as well.

Please call your local Councillor if you have questions about this or want additional information.

The final decision on this proposal is expected by mid to late August,so please take action now!

On behalf of Council,

Reeve Carolyn Kolebaba